The smart Trick of Paul B Insurance That Nobody is Talking About

Wiki Article

Getting My Paul B Insurance To Work

Allow's suppose you pass away an unforeseen fatality at a time when you still have several milestones to accomplish like youngsters's education, their marital relationship, a retirement corpus for your partner etc. There is a financial debt as a real estate financing. Your unexpected demise can place your household in a hand to mouth situation.

Despite exactly how hard you try to make your life much better, an unanticipated occasion can totally turn points inverted, leaving you literally, emotionally and monetarily strained. Having adequate insurance policy assists in the feeling that a minimum of you do not need to believe regarding money during such a tough time, as well as can focus on recovery.

Such therapies at great health centers can set you back lakhs. So having medical insurance in this situation, conserves you the fears and stress and anxiety of setting up money. With insurance coverage in position, any monetary tension will be cared for, and you can concentrate on your healing. Having insurance coverage life, health and wellness, and liability is a crucial part of economic planning.

Little Known Facts About Paul B Insurance.

With Insurance compensating a large part of the losses services and families can bounce back instead conveniently. Insurance coverage firms merge a large quantity of cash.

Insurance coverage is often a long-lasting contract, particularly life insurance policy. Paul B Insurance. click here for info Life insurance policy plans can proceed for more than three decades. Within this time they will accumulate a huge amount of wealth, which goes back to the financier if they make it through. Otherwise, the wealth goes to their family members. Insurance policy is a crucial financial tool that assists in managing the unexpected expenses efficiently without much headache.

There are generally 2 types of insurance coverage and also let us comprehend exactly how either is pertinent to you: Like any accountable individual, you would have prepared for a comfy life basis your income and profession estimate. They also supply a life cover to the guaranteed. Term life insurance coverage is the pure form of life insurance coverage.

If you have a long time to retire, a deferred annuity offers you time to invest for many years and build a corpus. You will obtain revenue streams called "annuities" till the end of your life. Non-life insurance is likewise referred to as basic insurance as well as covers any type of insurance policy that is outside the province of life insurance policy.

In the case of non-life insurance coverage, elements such as the age of the possession as well as deductible will additionally affect your option of insurance policy plan. Forever insurance coverage strategies, your age and also wellness will certainly influence the costs expense of the plan. If you possess an automobile, third-party insurance protection is necessary prior to you can drive it when traveling.

The Single Strategy To Use For Paul B Insurance

Please note: This short article is provided in the general public passion and meant for general information functions only. Readers are advised to exercise their caution and not to depend on the components of the article as conclusive in nature. Readers must research more or consult a specialist hereof.

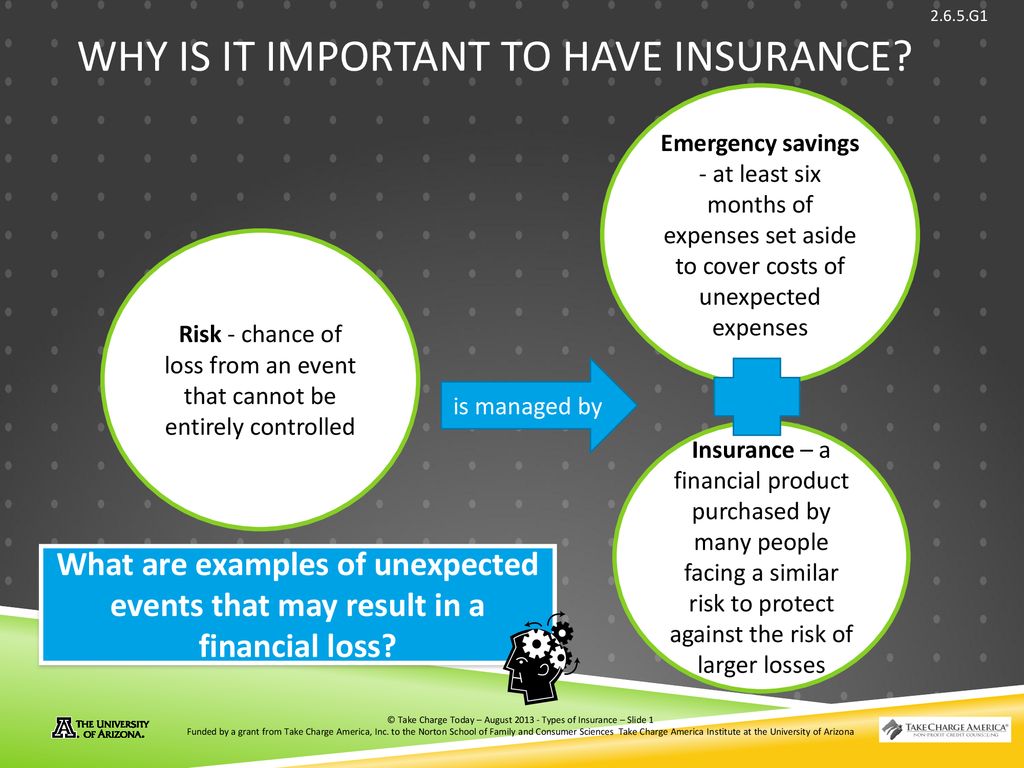

Insurance policy is a lawful arrangement in between an insurance coverage company (insurance company) as well as a private (insured). In this situation, the insurance company assures to compensate the insured for any kind of losses sustained due to the protected backup taking place.

The main functions of Insurance coverage are: The crucial feature of insurance policy is to protect against the possibility of loss. The moment and also amount of loss are unforeseeable, and also if a risk occurs, the person will certainly incur a loss if they do not have insurance policy. Insurance policy makes sure that a loss will be paid and consequently protects the guaranteed from suffering.

The smart Trick of Paul B Insurance That Nobody is Talking About

The procedure of determining premium rates is likewise based on the plan's risks. Insurance coverage gives settlement assurance in the event of a loss. Better preparation and also administration can aid to decrease the risk of loss (Paul B Insurance).

There are a number of additional functions of Insurance. These are as complies with: When you have insurance, you have actually ensured money to spend for the treatment as you obtain correct monetary support. This is just one of the vital additional functions of insurance coverage whereby the basic public is shielded from disorders or accidents.

The feature of insurance is to eliminate the anxiety and misery related to fatality and building damage. A person can devote their body as well as soul to much better accomplishment in life. Insurance coverage provides a motivation to strive to much better individuals by safeguarding society versus large losses of damage, devastation, as well as fatality.

our website

Paul B Insurance Can Be Fun For Everyone

There are several roles and importance of insurance policy. Some of these have been provided listed below: Insurance policy cash is bought countless initiatives like water system, energy, and also freeways, adding to the country's general economic success. As opposed to concentrating on a single individual or organisation, the risk affects numerous individuals as well as organisations.

It encourages threat control activity since it is based upon a danger transfer mechanism. Insurance coverage can be utilized as security for credit rating. When it concerns a house loan, having insurance policy protection can make acquiring the financing from the lender easier. Paying taxes is among the major duties of all citizens.

25,000 Section 80D Individuals as well as their family plus parents (Age less than 60 years) Overall Up to Rs. 50,000 (25,000+ 25,000) Section 80D People and also their household plus parents (Age even more than 60 years) Amount to Rs. 75,000 (25,000 +50,000) Area 80D Individuals and also their household(Anyone above 60 years old) plus parents (Age even more than 60 years) Complete Up to Rs.

Getting The Paul B Insurance To Work

pop over to this web-siteAll sorts of life insurance coverage plans are offered for tax obligation exemption under the Revenue Tax Obligation Act. The advantage is obtained on the life insurance policy plan, whole life insurance coverage strategies, endowment plans, money-back policies, term insurance coverage, and Device Linked Insurance Plans. The maximum reduction available will certainly be Rs. 1,50,000. The exception is given for the premium paid on the policies considered self, partner, reliant youngsters, and reliant moms and dads.

Every person should take insurance coverage for their well-being. You can choose from the various kinds of insurance coverage as per your demand.

Insurance coverage promotes relocating of danger of loss from the insured to the insurance company. The basic principle of insurance is to spread out danger amongst a multitude of people. A huge population obtains insurance coverage and pay premium to the insurance provider. Whenever a loss occurs, it is made up out of corpus of funds gathered from the millions of policyholders.

Report this wiki page